Neat Tips About How To Apply For A Secured Credit Card

No credit check to apply.

How to apply for a secured credit card. The card featured in this review—capital one quicksilverone—offers rewards on the lower end of that scale (unlimited 1.5% cash back) in exchange for a $39 annual fee. You want a card you can afford to carry that. Our recommendations for secured cards (that when used responsibly can significantly improve your credit score) let’s get into it!

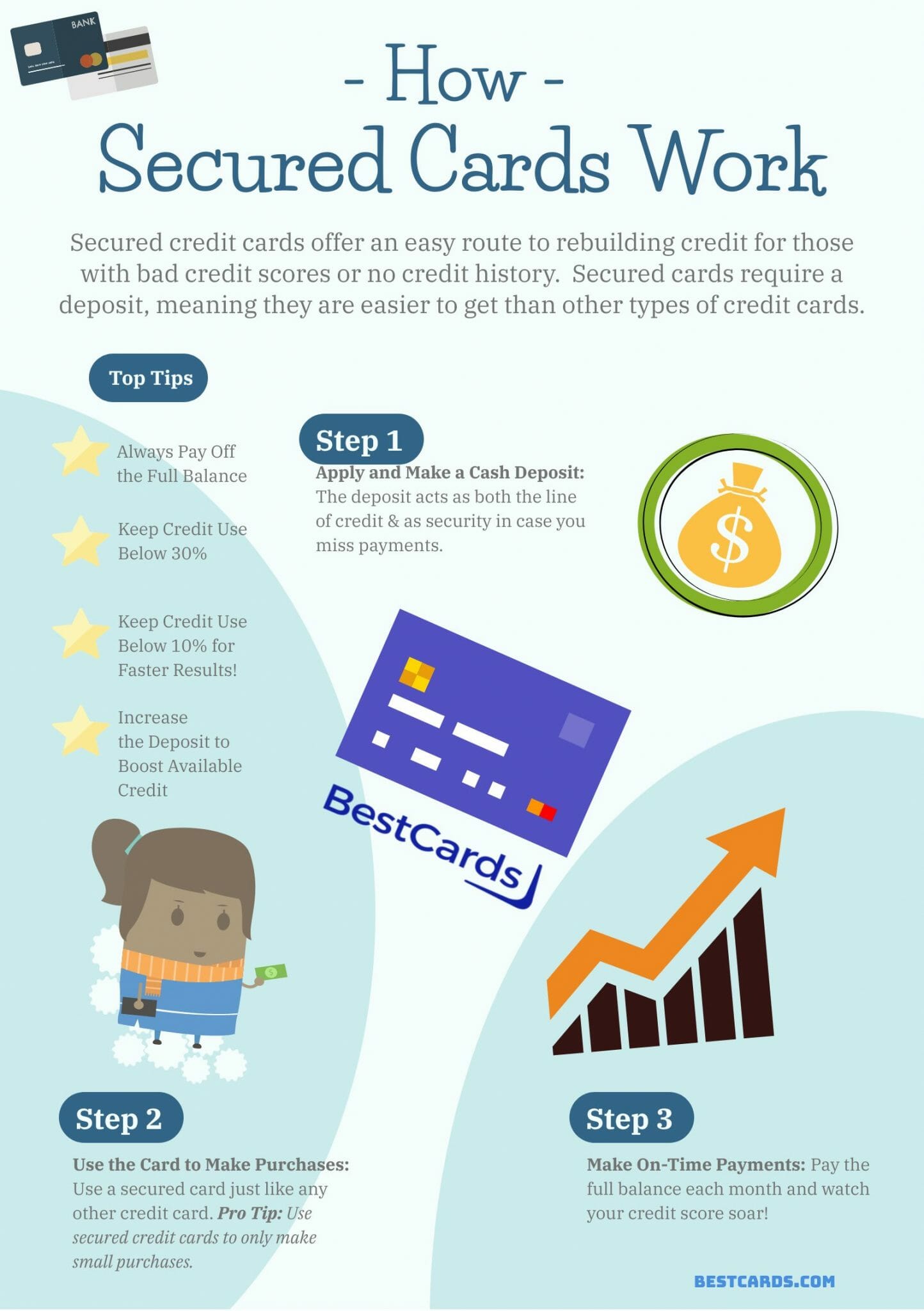

That said, these cards come with a. With a secured credit card, the amount you deposit, or use to. The best secured cards also report to the major credit bureaus on a monthly basis, making it possible to build or rebuild your credit standing with responsible use.

The card carries an apr of 19.24% (variable for purchases) and 25.24% (variable for cash advances). Opensky® secured credit visa® card. How to choose a secured credit card:

Issuers design secured credit cards as a more accessible way to build or repair your credit, and some cards even provide solid rewards without an. #businesscredit #grants #financialempowerment #entrepreneurlife #businessgrowth #smallbusinessfunding #creditbuilding #quiztime #chasebank #fundingyourdreams #financialfreedom #viral #instagramreels #explorepage my $800k chase bank. An annual fee of $39 applies to the first progress.

Compare the best secured card offers and apply online directly. Here are our top picks. How to apply for secured credit cards in the philippines.

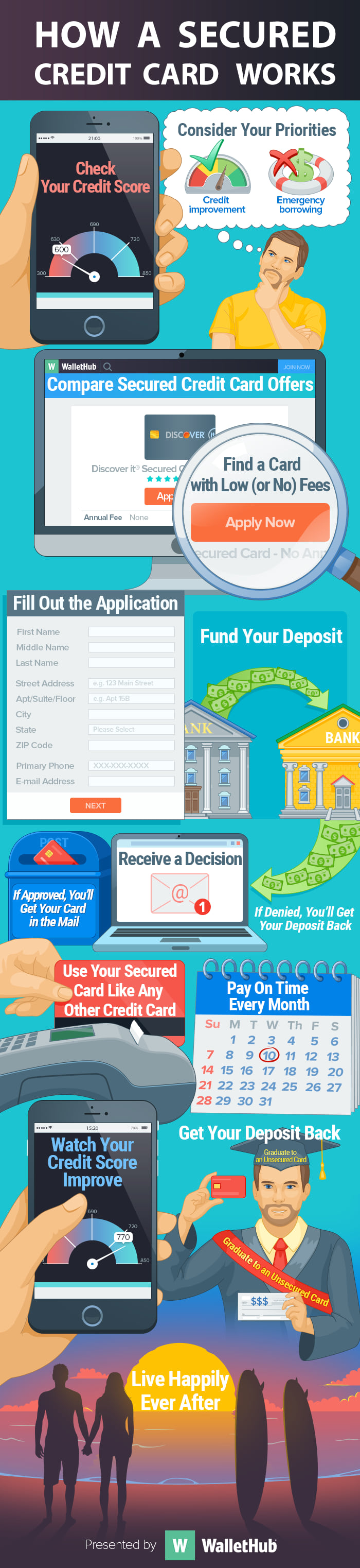

Below, you'll find application links for the credit. Dbs altitude secured credit card. If you know your credit score, you’’l be able to narrow down what type of credit card you might qualify for.

Get it, use it to improve your credit enough to qualify for better options, and then move up to an unsecured. A secured credit card requires you to make a cash deposit to the credit card issuer to open your account. Applying for a secured credit card requires you to make a cash deposit, usually in the form of a fixed deposit with the lender.

The best secured credit cards to build credit have annual fees as low as $0, in addition to very attractive rewards in some cases. Some of our selections for the best secured credit cards to build credit can be applied for through nerdwallet, and some cannot. Apply for a secured credit card.

How to apply for a secured credit card? Apply for the bankamericard® secured credit card to start building your credit and enjoy access to your fico® score updated monthly for free. Secured credit cards can be a great option if you want to improve or build your credit.

A secured credit card is a tool designed for people with bad credit who want to build or rebuild a positive credit score. When opening a secured card, you’ll need to deposit. How to choose a secured credit card: