Formidable Tips About How To Avoid Alternative Minimum Tax

Learn how to reduce or even eliminate your amt bill by deferring income, contributing to retirement plans, creating tax.

How to avoid alternative minimum tax. Updated on february 10, 2023. Who has to pay the alternative minimum tax? How can you avoid the amt?

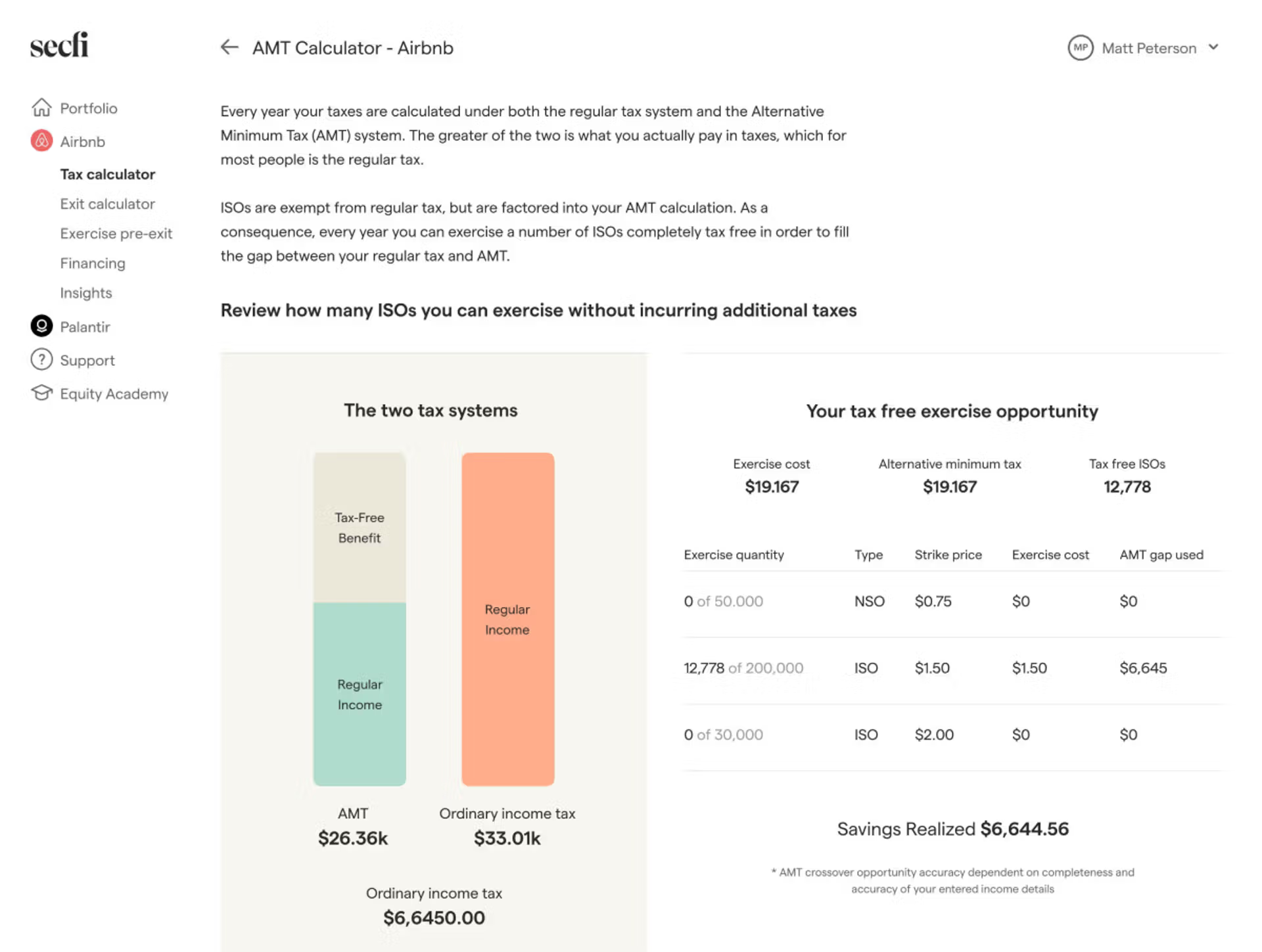

Due to tax reform, fewer filers are expected to pay the alternative minimum tax, or amt, this year. File your taxes with confidence. The last step to calculate your anticipated amt is reducing the amt you calculated in step 5 by regular tax.

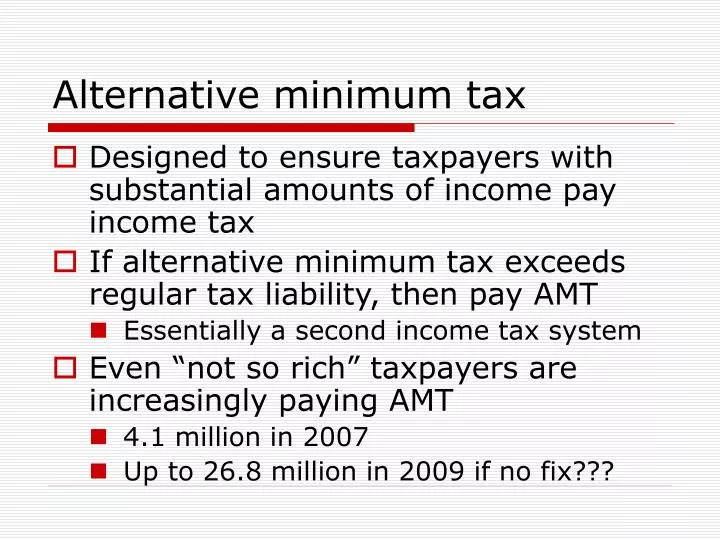

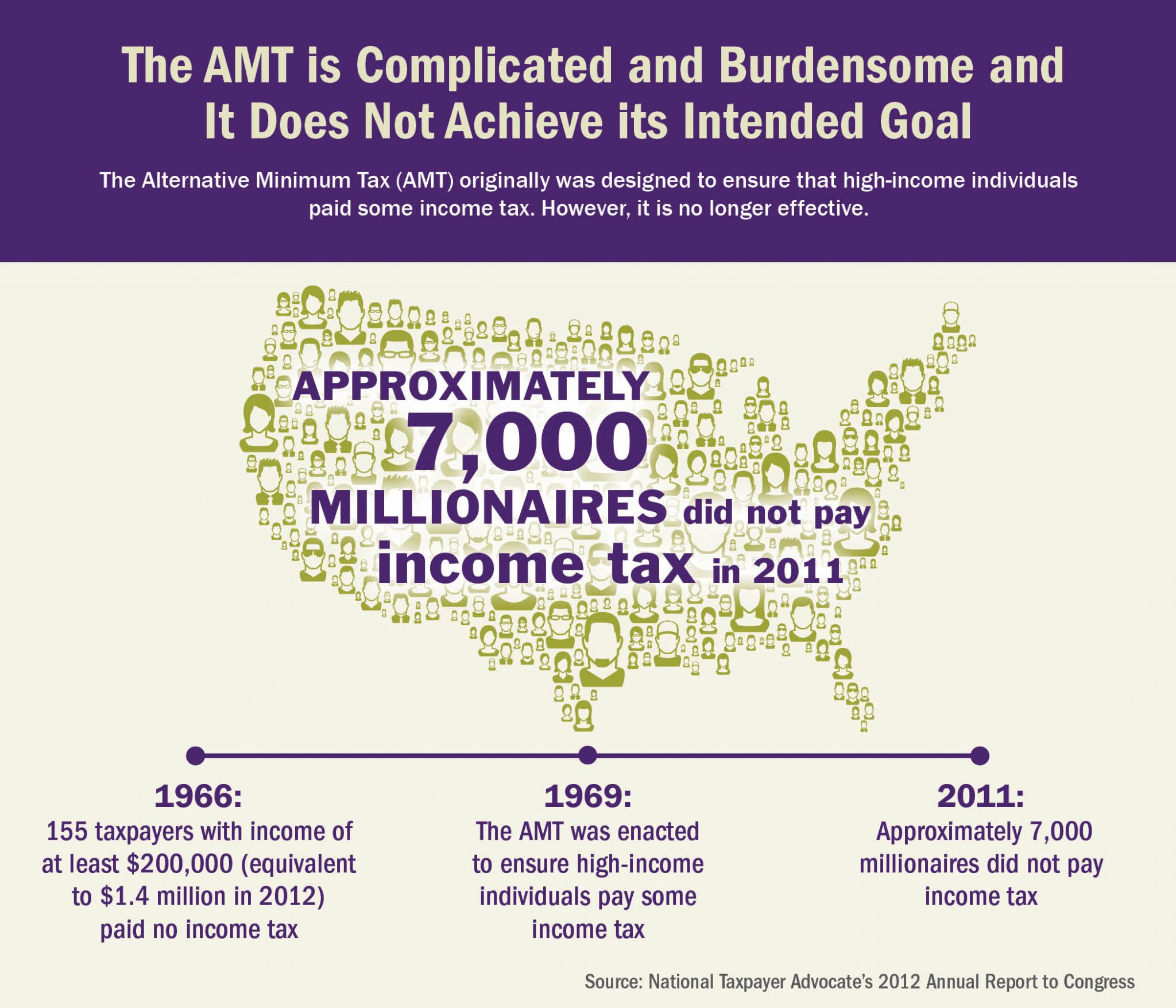

The alternative minimum tax (amt) system imposes a minimum level of tax on taxpayers who claim certain tax deductions, exemptions or credits to reduce the. Proposed changes to the alternative minimum tax ─ how will it affect individuals and trusts? Alternative minimum tax refers to tax applied in addition to the regular tax to prevent taxpayers with high economic income from reducing the tax payable below a fair.

October 20, 2023 | 5 min read. What's the alternative minimum tax and who pays it? What is the alternative minimum tax (amt)?.

The alternative minimum tax (amt) applies to taxpayers with high economic income by setting a limit on those benefits. The alternative minimum tax was designed to prevent wealthy taxpayers from using loopholes to avoid paying their fair. It’s hard to avoid paying taxes.

It helps to ensure that those. Reduce your calculation from step 5a (or 5b, if. Basics of alternative minimum taxes how to calculate amt criticism of amt alternative minimum tax faqs.

An alternative minimum tax (amt) is the. Eligibility for tax breaks and the amt. What is the alternative minimum tax in canada?.

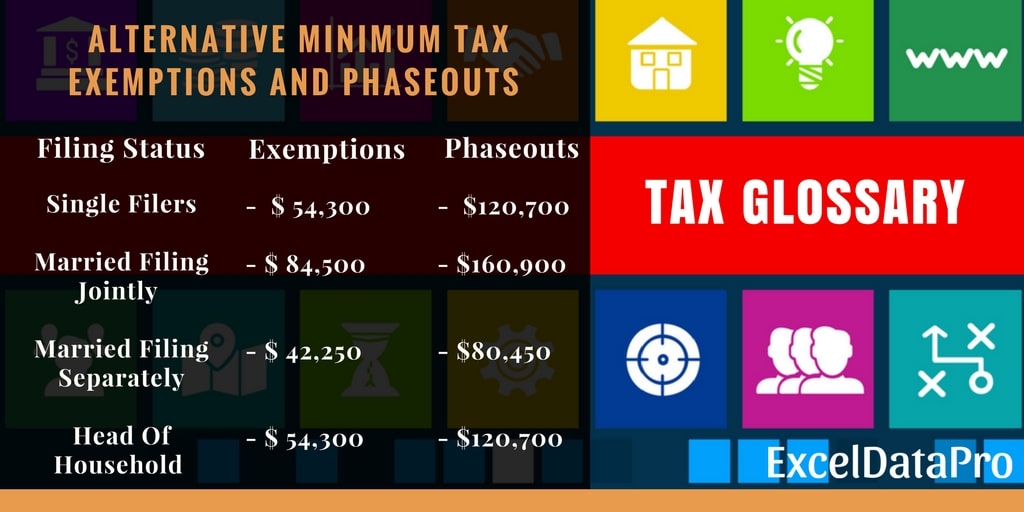

Internal revenue service instructions for form 6251;; What is the amt exemption for 2022 and 2023? Updated for tax year 2023.

Are you now safe from the alternative minimum tax? If you believe you may be put into a higher tax bracket — whether you switched to a job with a much higher income or earned way more.