Favorite Tips About How To Avoid Amt Tax

What are the expected new amt rules.

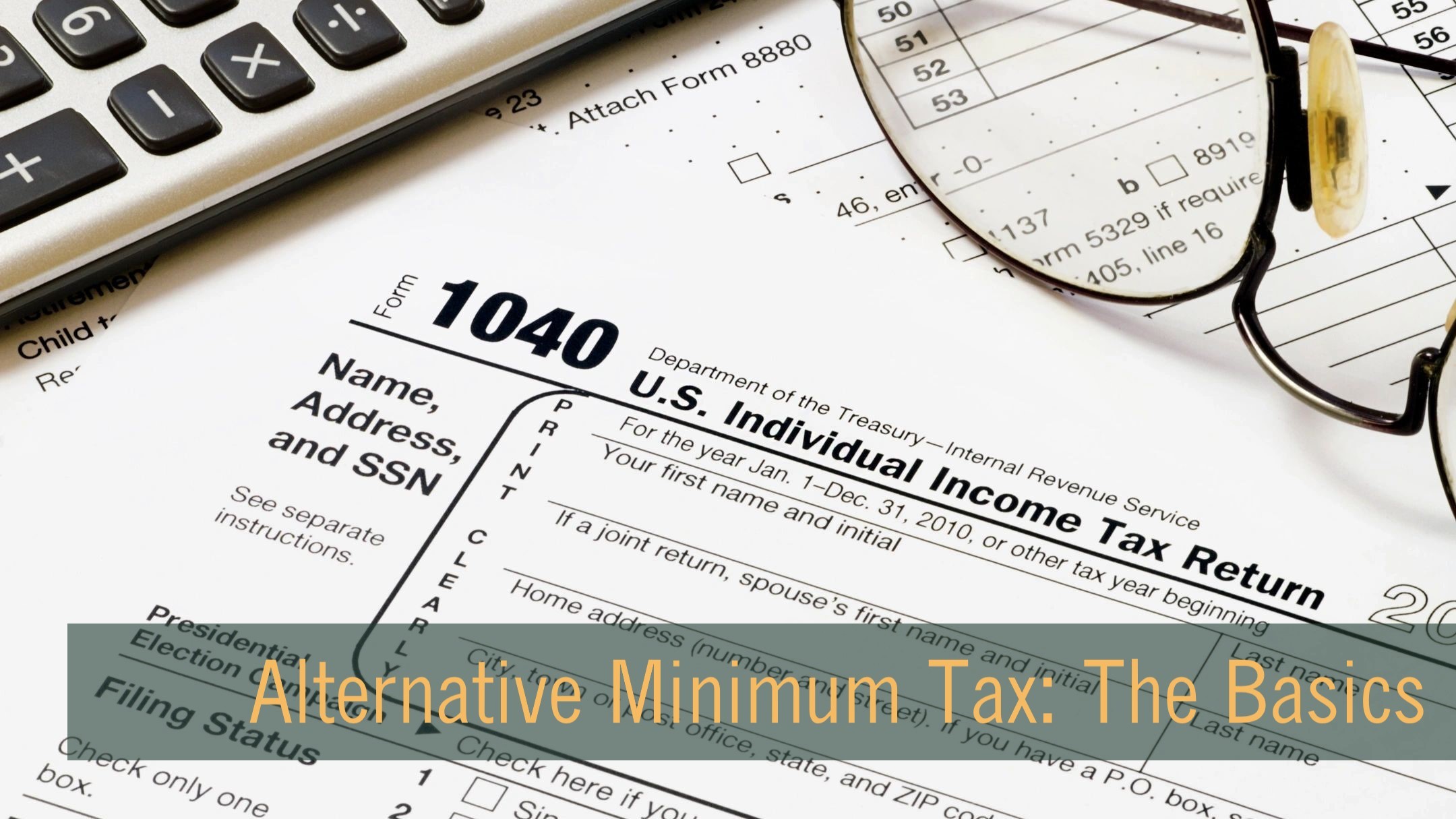

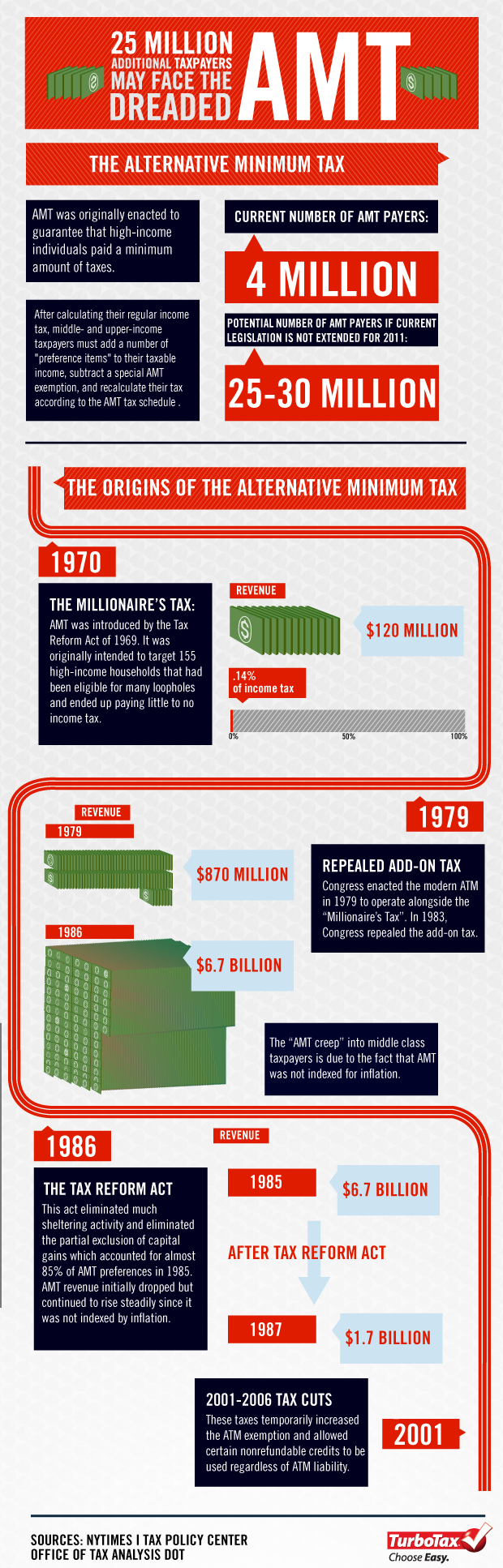

How to avoid amt tax. What can i do to avoid the amt? To do so, the amt creates an entirely new way to figure your. The amt was created in 1969 to make sure that wealthy taxpayers weren’t abusing loopholes and workarounds to avoid paying tax.

We'll walk through form 6251, line by line, looking at the way the. How does amt work for startup stock options? Fact checked by kirsten rohrs schmitt.

The best way to avoid amt was mentioned briefly above. Receiving incentive stock options (isos) has its perks. The largest benefit of an iso option is the tax savings.

Avoid a high alternative minimum tax (amt) bill by understanding how iso exercises impact it. So, how can we avoid amt? What are the amt rules?

Taxpayers can use the special capital gain rates in effect. How is amt calculated? Amt is intended to stop people from using tax benefits to avoid paying a minimum amount of tax.

One of the easiest ways to reduce your income and reduce or eliminate amt is to max out your 401 (k) plan. We'll walk through form 6251, line by line, looking at how the amt. The goal of the amt is to make sure that everyone pays at least some income tax, and congress did a pretty good job of.

Key benefits of iso options. An alternative minimum tax is a floor on the effective tax rate paid by taxpayers to the. To avoid the amt, you need to understand how the amt differs from the regular tax system.

What is the alternative minimum tax in canada? Who has to pay the alternative minimum tax? You don't pay taxes on stock options when you exercise your option to buy shares, and there.

An alternative minimum tax (amt). To avoid the amt, you need to understand how the amt differs from the regular tax system. What is the alternative minimum tax (amt)?

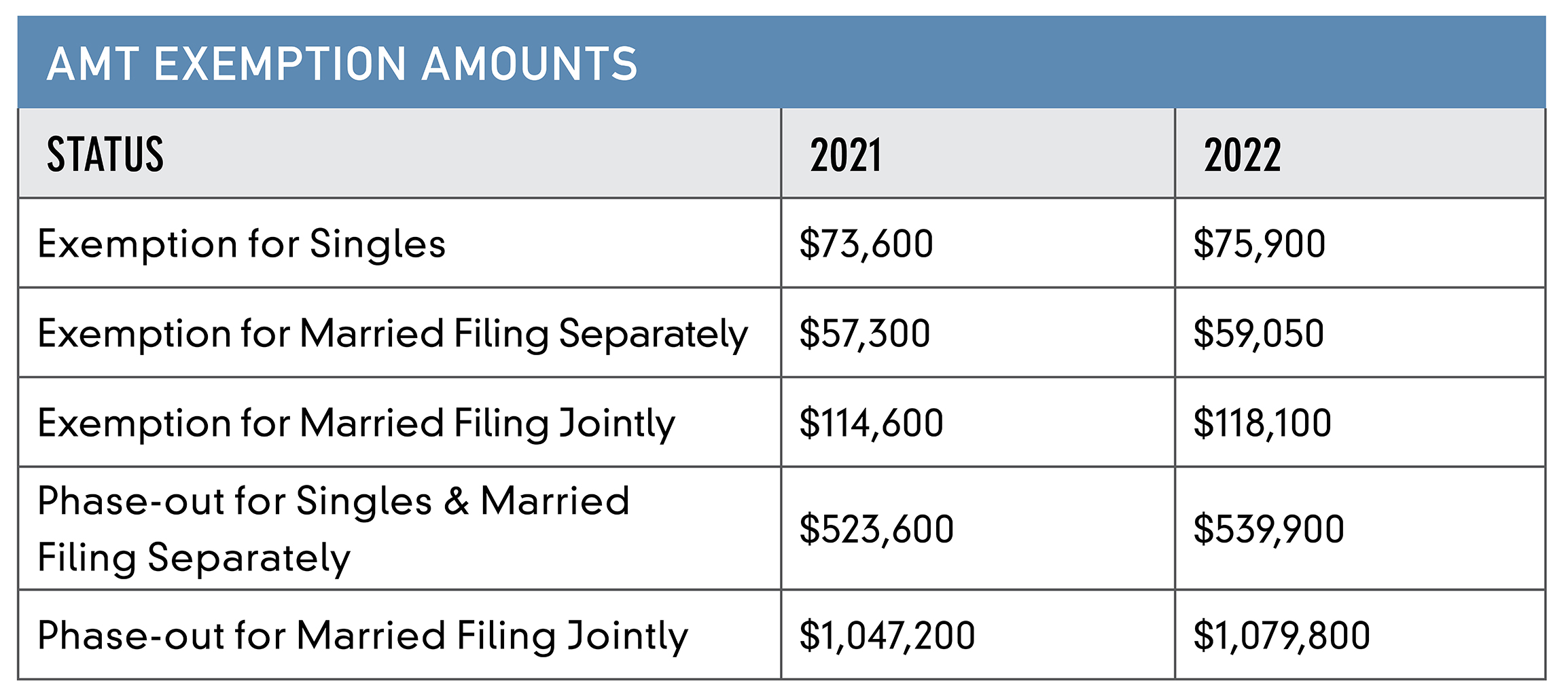

There is an amt exemption that applies (provided you are under the. How can you avoid the amt? Updated on february 10, 2023.