Here’s A Quick Way To Solve A Tips About How To Be A Loan Officer

They work in various financial institutions, such as banks, credit unions, and mortgage companies.

How to be a loan officer. Updated july 21, 2022. How to become a loan officer. A loan officer is a professional who processes loan applications and evaluates them for eligibility and suitability to ensure that nothing stands between business or personal goals.

Obtain a high school diploma or equivalent. Here is a closer look at each of the basic steps to becoming a mortgage loan officer: What are the benefits of becoming a loan officer?

Here's a guide on how to become a loan officer: In today’s rapidly evolving financial landscape, the role of a loan officer has taken on a new dimension. What is a loan officer?

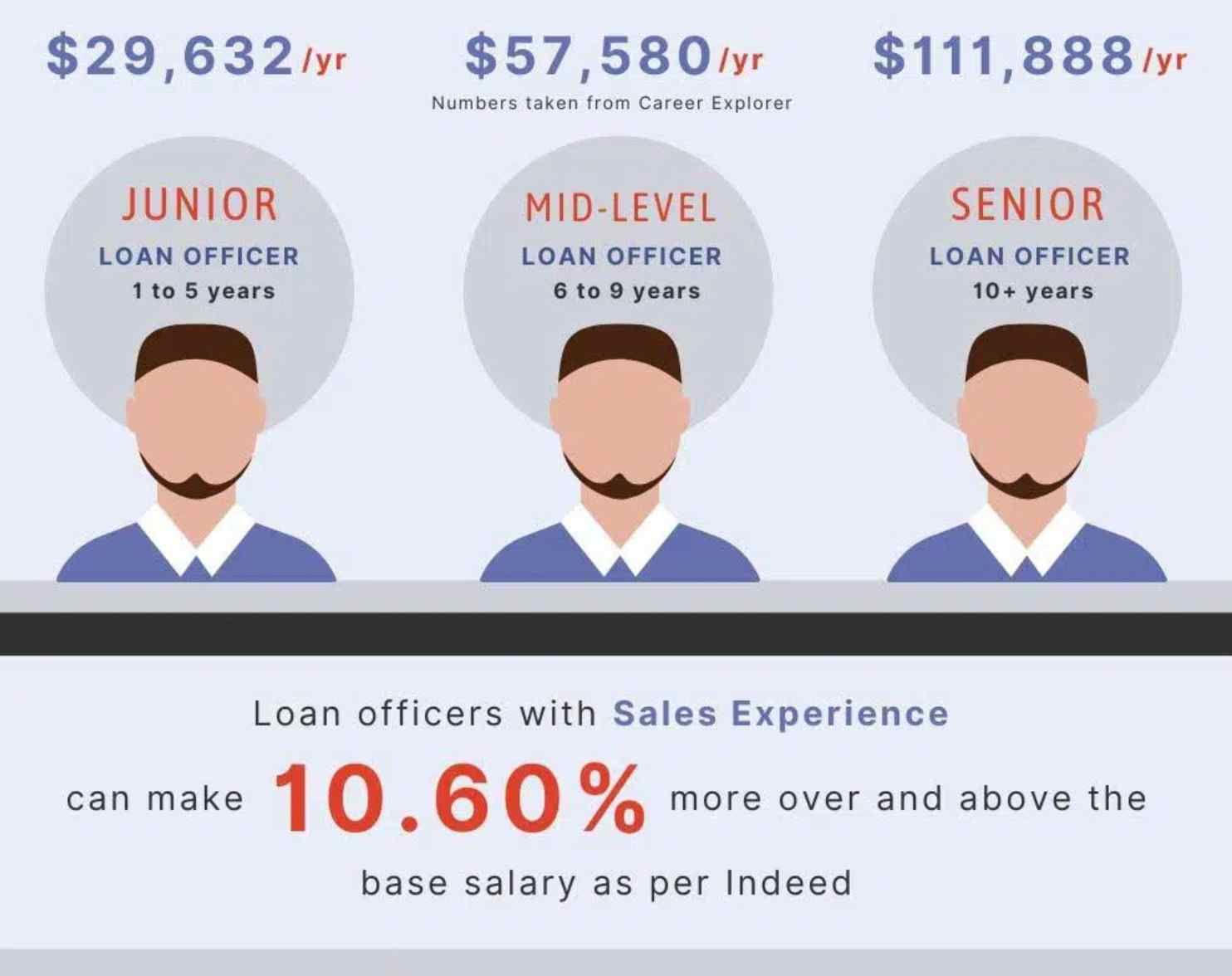

What is the salary and job outlook for loan officers? While a college degree is not always mandatory, having a background in finance, business, or a related field can be beneficial. Definition of a loan officer.

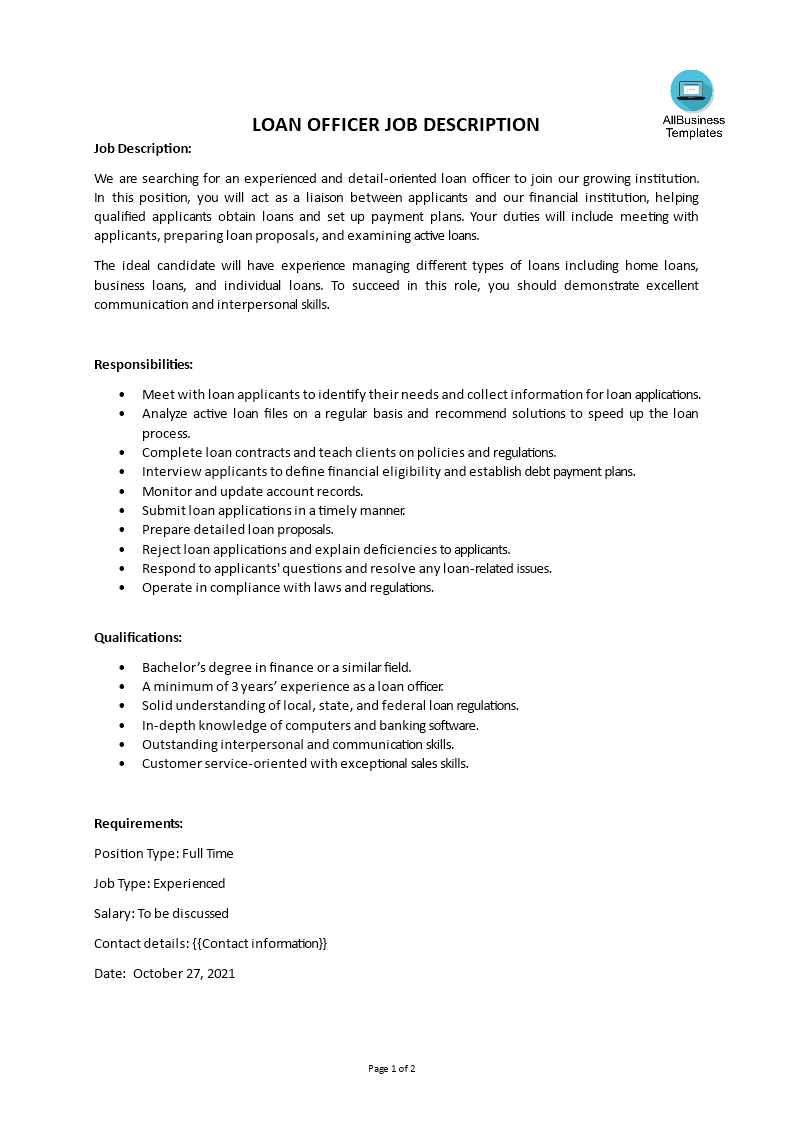

Job description example. A loan officer is a representative of a bank, credit union, or other financial institution who assists borrowers in the. Loan officer is one of the most widespread positions in the mortgage industry and fulfills vital functions in firms across the usa.

Showcase your skills with help from a resume expert. How to become a loan officer. How do you get loan officer training?

Loan officers are financial experts who evaluate, authorize, or recommend approval of loan applications for individuals and businesses. Their primary role is to process loan applications by studying the credit history of potential borrowers and assessing risks to ensure that borrowers are creditworthy. Becoming a loan officer can be a great career path if you are interested in finance and have excellent people skills.

As a loan officer, you will be responsible for evaluating loan applications, assessing creditworthiness, and making informed decisions regarding loan approvals. Loan officers are responsible for meeting with customers to take loan applications, reviewing financial information, and making sales on behalf of the financial institution. In most cases, loan officers undergo the underwriting process to approve or deny you for loans.

What does a loan officer do? To become a mortgage loan officer, you need to be at least 18 years old and have a high school diploma or ged. What's it like to be a loans officer?

Loan officers work in banks and other financial institutions that offer loan services. Once they receive your financial. Here is a list of some of the benefits of becoming a loan officer.

/loan-officer-526035_final-f4ca32ef67784514a9cd7f42a9bc8bf9.png)

![How to a Loan Officer [StepbyStep License Guide]](https://lo.vintagelending.com/wp-content/uploads/2021/03/how-to-become-a-loan-officer-infographic-768x1920.png)