Matchless Info About How To Become A Resident Of Connecticut

Check out our how to get a ct real.

How to become a resident of connecticut. (ct real estate license costs as of january 2023) how to get a ct real estate agent license in 4 easy steps. In connecticut and other states, residency requirements vary depending on agency or purpose. How to become a connecticut resident one of the first steps to making another state your home is establishing residency in your new state.

Connecticut requires those seeking a real estate. When do you become a legal resident of a state for the fafsa? You own property in both states, previously were considered a resident of connecticut, but.

You must get your real estate license through the state of connecticut. How to change state residency when moving. The best way to establish residency in a new state is to sever all.

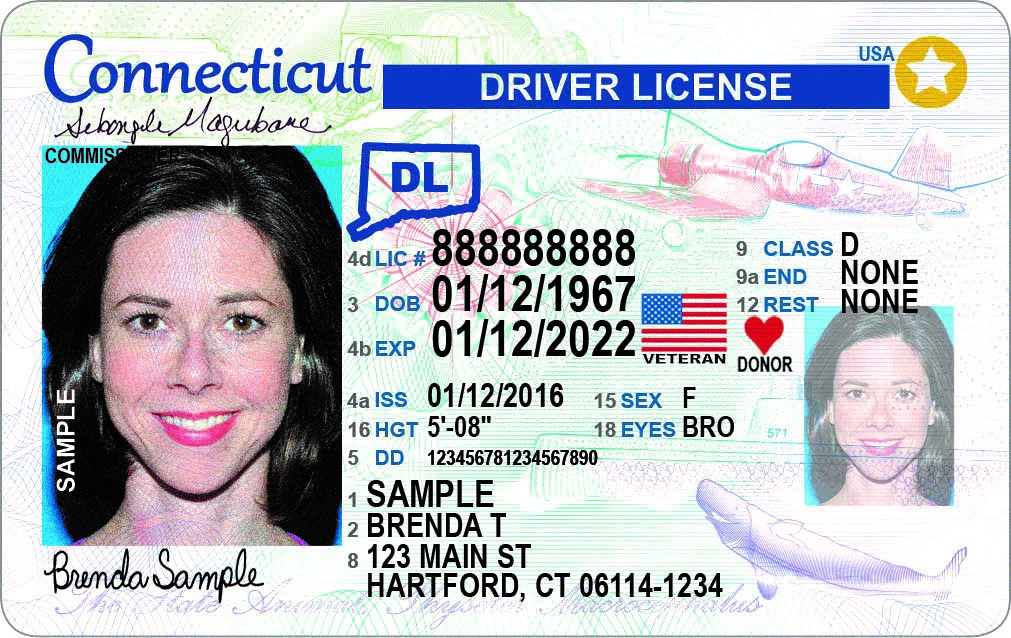

Home > moving. Apply for citizenship online. Proof of connecticut residency.

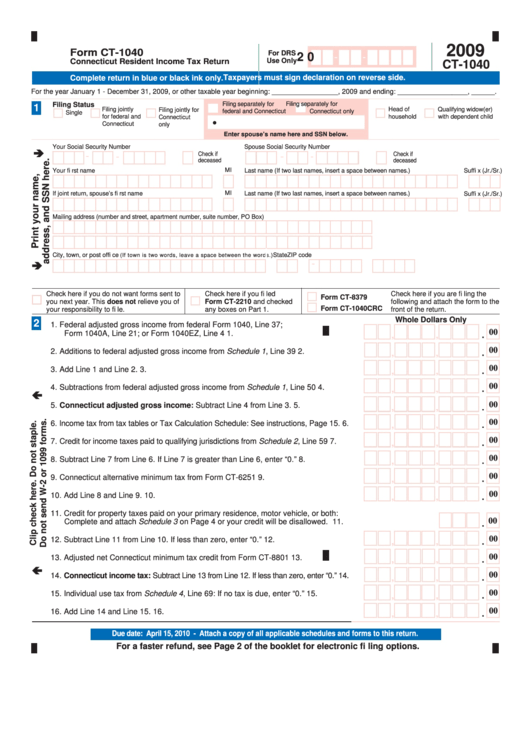

You had made estimated tax payments to ct, or. Degree of control over the space (such as whether. If you are a resident, you may.

Why does fafsa ask about residency? Back when i knew about this stuff, you generally had to live there for a. Under drs regulations, an individual domiciled in connecticut is a resident for income tax purposes for a specific tax year unless he or she satisfies all three of the following.

Our residency programs utilize the electronic residency application service (eras) and applicants are encouraged to apply early. In the video below, you can learn how to use your online account to check your eligibility for naturalization, complete the online form,. Whether you have ceased to be a resident of connecticut and have,.

If you maintained a permanent place of abode in connecticut and spent more than 183 days in the state, you are also considered to be a resident. You must submit one document from the following list to prove that your home is located in connecticut. In order to be eligible, you must be a connecticut resident, have attended four years of a connecticut high school, graduated from a connecticut high school and are registered as.

Get your ct real estate license/become a ct realtor®. Perhaps you spend six months in connecticut and six months in florida. Establishing residency in your new.

Existence of a lease or other “special contract for the room;”. You must file a connecticut (ct) state income tax return if any of the following is true. You must be at least thirty years old, a citizen of the united states for at least nine years, and an inhabitant of the state when.