Stunning Tips About How To Claim Rent Tax

Actual hra received from the employer.

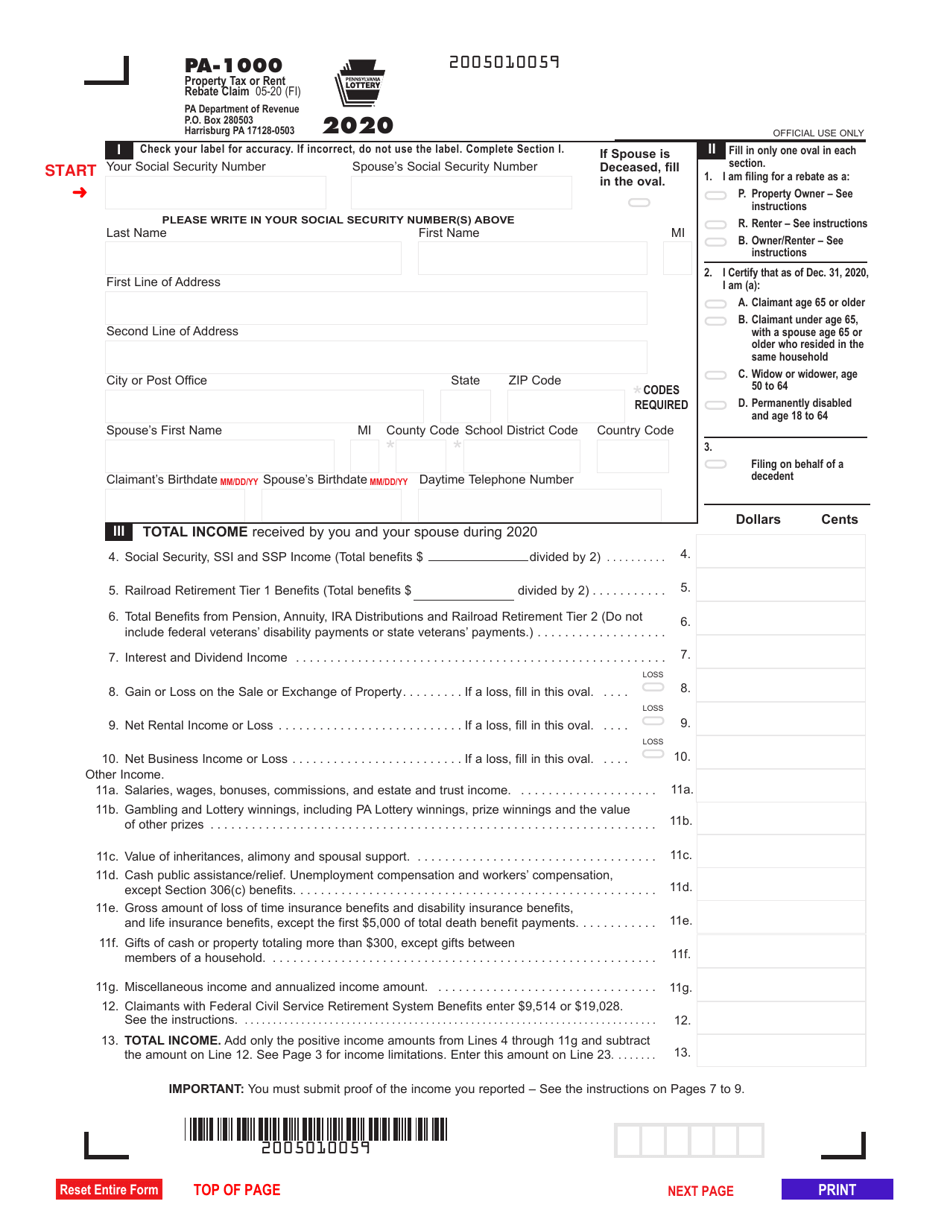

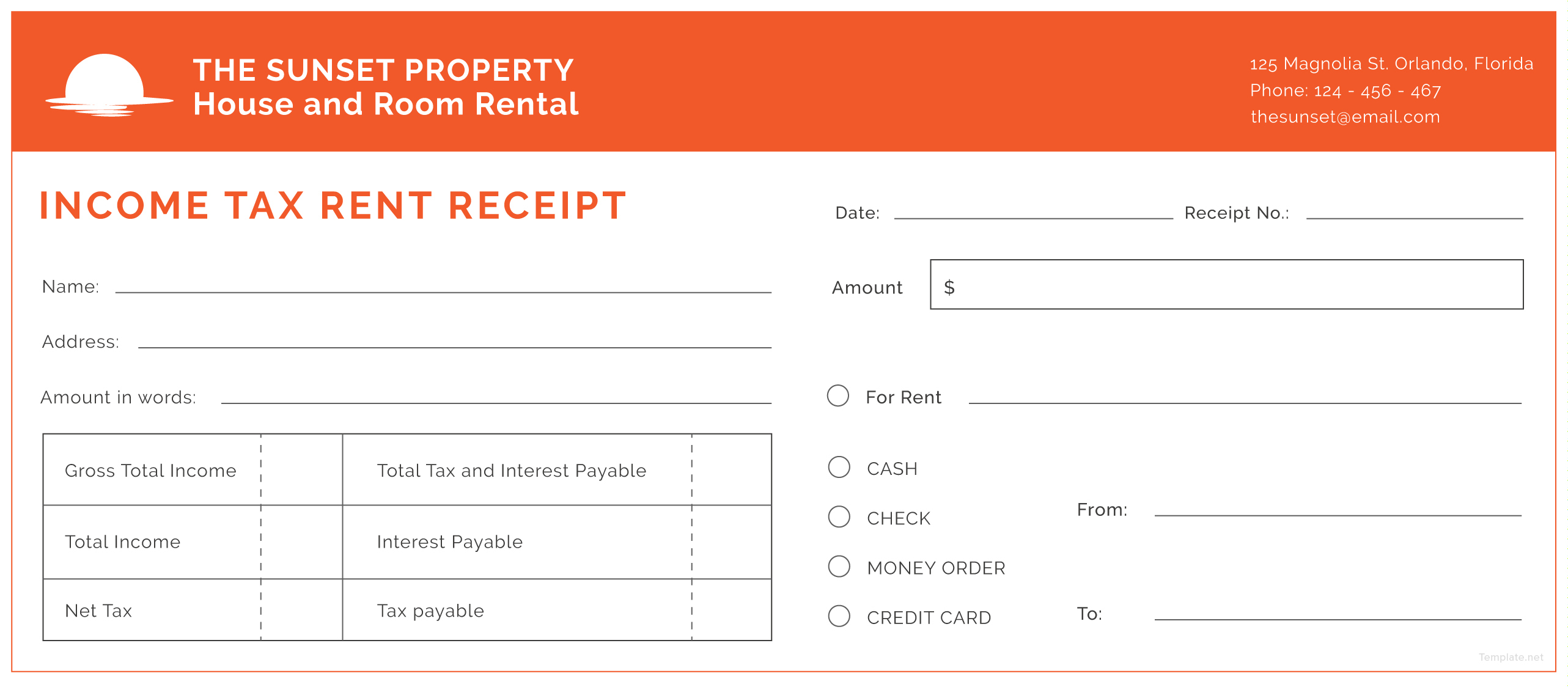

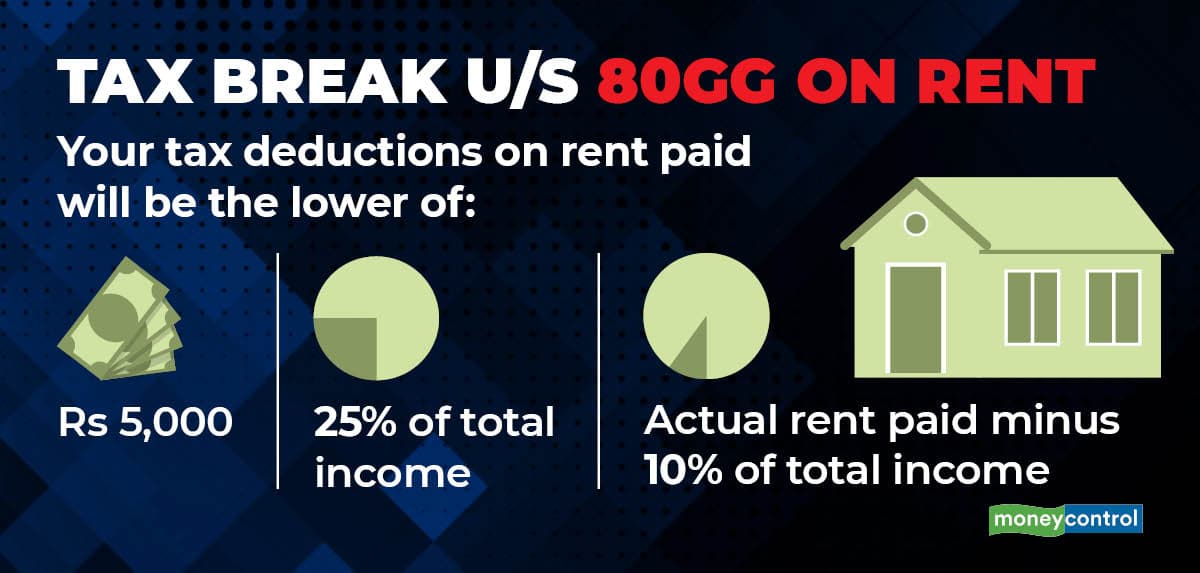

How to claim rent tax. For the 2023 and subsequent tax years, you can claim the renter’s tax credit if you meet the following criteria: For example, if you own a rental. Annual rent paid, minus 10% of the salary.

In february 2018, you bought a rental house for $135,000 (house $120,000 and land $15,000) and immediately began renting it out. This will also be backdated to allow for claims to be made for the 2022 and 2023 tax years. In california, renters who pay rent for at least half the year, and make less than a certain amount (currently $43,533 for single filers and $87,066 for.

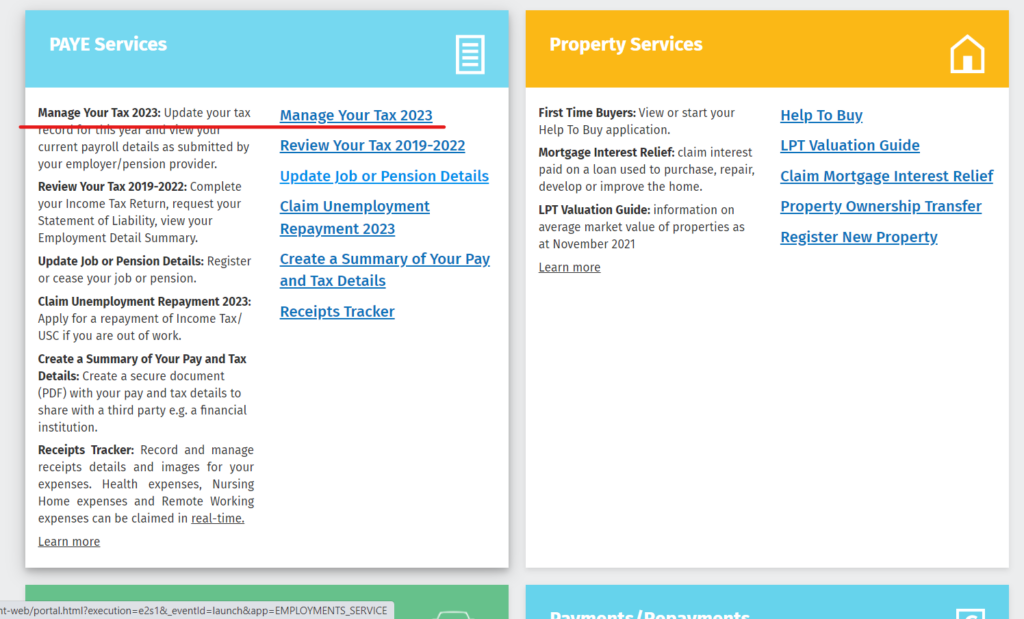

For paye workers, this can be done through revenue.ie. Home office tax deduction. Locate the ‘rent tax credit’ section of the tax return and enter the information requested.

There are three provinces that offer tax benefits or credits that you can claim your rent within: 50% of the employees basic salary (for employees residing in metro cities) or. All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income.

You can also claim the tax credit for payments made in. Utilities such as electricity, water, gas, and internet service are often prorated based on the area of the room rented out compared to the entire house. Despite putting hundreds of euro back in renters' pockets,.

19 is the first day you can file your taxes online and there are some key changes that will affect the tax filings of many people in canada. Rent is the amount of money you pay for the use of property that is not your own. However, if you use the property for your trade.

Seniors may be eligible for an additional amount if their household income is under. This means that if you sell your home for a gain of less than $250,000 (or $500,000 if married, filing jointly), you will not be obligated to pay capital gains tax on. If 10% of your home is used for work or to run.

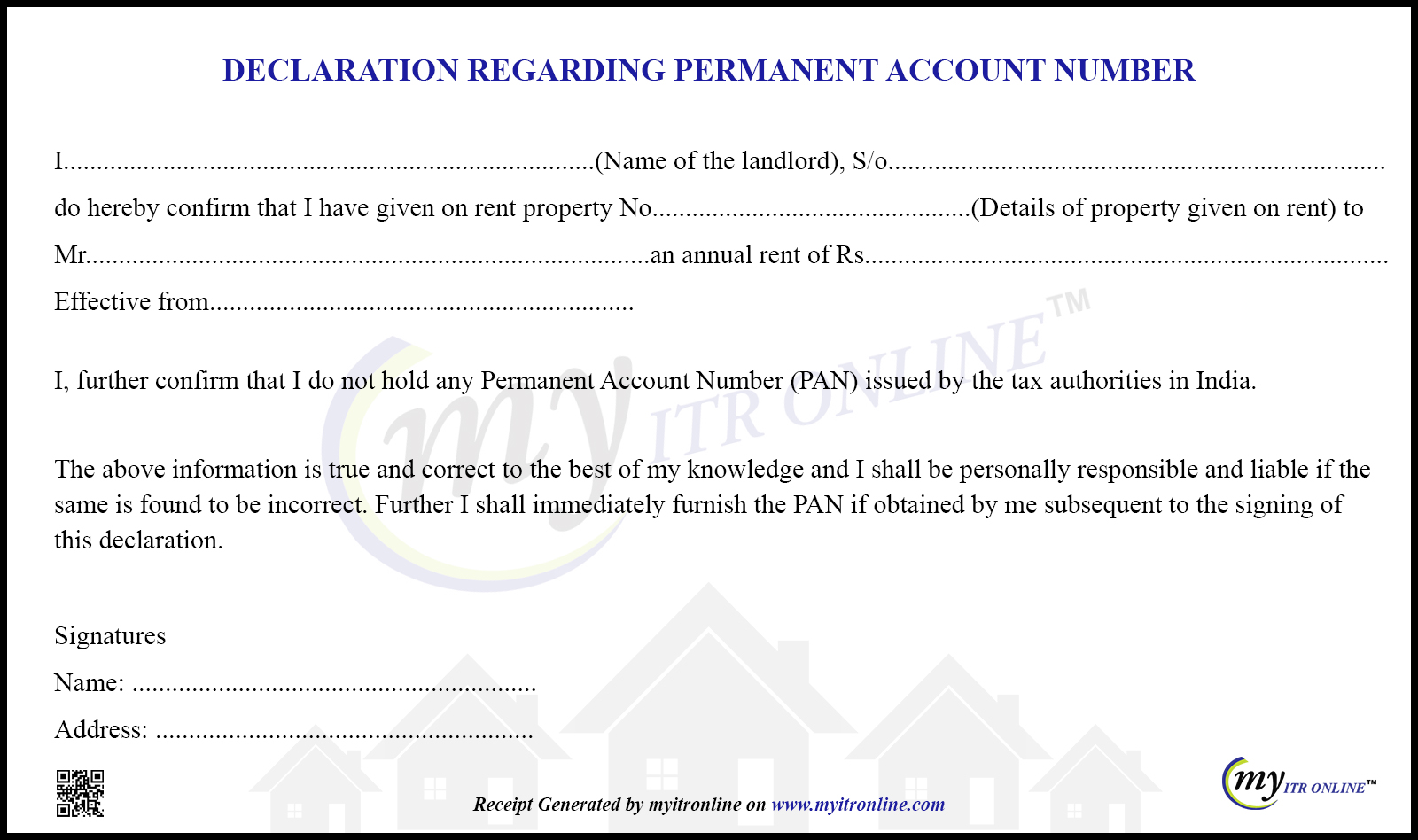

Select the tax year for which you wish to file a return (select 2022). Here’s how it works: Anyone paying rent on private rental accommodation is entitled to claim the €500 rent tax credit this month, that was.

Canadians can begin filing their. Over 400,000 people are in line to receive €500 via a rental tax credit announced as part of budget 2023 from january 1. How much can you claim?

Beginning in 2033, the maximum percentage of your. Deducting rent on taxes is not permitted by the irs. Written by eric reed if you’re wondering whether you can deduct your rent on your taxes, the short answer is yes.